Challenging the Cloud The Rise and Fall of Nirvanix

A dramatic story of building a company with all the drama, intrigue, wins, losses and murder

It was 2007 and cloud computing was in its relative infancy. Salesforce had launched just eight years prior and was starting to gain considerable traction. Former colleague, Patrick Harr and his former college roommate Geoff Tudor had an idea to transform a former free consumer facing file storage company into an enterprise cloud storage company.

Streamload, founded in 1998 in San Diego, California by Steve Iverson, a student at Pomona College, was one of the first Internet storage services, receiving various accolades for products between 2002 and 2006. The company attracted angel investor and computer software entrepreneur Charlie Jackson and $1.2 million in investment by August 2004.

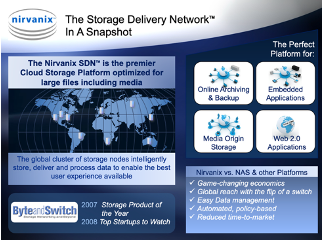

Streamload’s flagship product was renamed to MediaMax and spun off on July 1, 2007, with the existing company being renamed to Nirvanix. Patrick Harr and Geoff Tudor wanted to pursue the storage service market for enterprise customers. A new Nirvanix system, called the Storage Delivery Network, was built with new software and hardware systems. Nirvanix incorporated both the lessons-learned operating a large-scale online storage service under Streamload as well as techniques in clustering, virtualization, database-driven file system architectures and distributed networking. Nirvanix filed nine patents on this new platform in August 2007. It announced its Nirvanix Storage Delivery Network in September 2007, comparing it to the Amazon Simple Storage Service.

With the platform now mostly repurposed and a future launch in its sights, in mid-2007 I got a call from Patrick Harr, the new CEO. He wanted to discuss the possibility of joining the company in San Diego as the Chief Marketing Officer (CMO) in time to launch the company as an enterprise storage company in the Fall. The appeal of working with my former colleagues on one of first cloud projects was too hard to pass up. It was clear to me at this point now that cloud was the way computing and storage was moving. I wanted to be on the bleeding edge.

In the pitch, Patrick explained that they had a distributed set of storage centers, each with a continuous backup of data in case of disaster. As CDN made sure that media files (large) could be automatically balanced across the Internet for optimization of interaction speed. All the elements were in place.

I signed the deal and set my starting date.

A week passed, while a month before my start date, and I was invited to an emergency call by the Nirvanix team. A wildfire was sweeping across the fields around San Diego and it was within a quarter mile of a Nirvanix data location and moving toward it.

“Well, redistribute the data to another node on the network and out of harms way. Problem solved, the rest is for the insurance company.” I said.

There was an awkward pause on the phone from everyone on the team. Apparently, I was the only one who didn’t know the truth behind the vision. Nirvanix only had one data center though it INTENDED to open five more and it was in the direct path of the fire. To make matters worse, the week prior, Patrick had cancelled the backup services to the site to save costs. My new company was within an hour of failing before it even launched.

Suddenly, the winds shifted, pushing the fires to the north of the data center, saving the business, our launch plans and dreams.

I had joined a month before launch. So much needed to be done. Hiring a PR firm, building out demand gen systems, locking down on messaging etc. I started at the company with one marketing manager and three unpaid interns. Things were run very lean. We locked on the name for the product almost immediately: “The Storage Delivery Network” (SDN) and we were going to refer to what we were doing as “cloud storage” even though that naming convention was nascent in the market. We saw it as not only accurate, but forward thinking, and that it would climb to en vogue.

Our bets were right. The interaction with Press and Analysts around the launch allowed us to expose the virtues of cloud computing and storage. A new utility was born.

Edgard Capdeville, who Patrick and I had worked with in a prior company, and coincidently once part of venture capital firm that funded my first startup, NetBrowser Communications, stepped in to be VP of Product. He developed an innovative and precent developer platform for the business. Edgard would later turn to Business Development to onboard CDNs to the platform.

In preparation of pushing into the enterprise space, we developed an appliance to sit on the customers site to act as a filer cache, something we branded CloudNAS. It was to become a pivotal component of our offering.

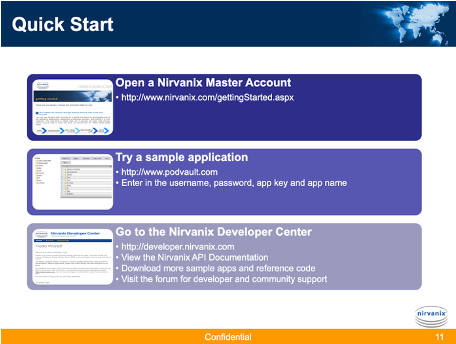

We built a robust developer program with APIs, materials and support personnel to attract developers to begin coding the SDN into their products. Within the year we would have over 600 developers creating products and interconnects with our platform.

One of the first developers in built a file storage solution within Facebook and his service was taking off. Media companies and CDNs were building apps with the SDN imbedded. But this wasn’t enterprise storage.

In the background, Nivanix wad receiving weekly visits from the Federal Bureau of Investigation (FBI) as the free storage side of the legacy business had been linked to the storage and serving of huge stashes of child porn and other illicit information. As the service was free and anonymous, it was subject to considerable abuse, but this was the business we were transitioning from.

Patrick and Geoff then brought in a hotshot enterprise sales VP named Dan Havens from Seattle to kickoff a true enterprise sales play. They drove sales hard. General Electric (GE) was the first enterprise client to fall. Then came The Planet, Nero, CDNetwork and many more.

That launch year we received “Top 10 Storage Company” in the rags and many other accolades followed including “Startup of the Year”. We were a dream team so much of the press wanted to interview.

Within a few months, a large technology company floated an unsolicited bid to buy the company at nearly 10X the invested capital. The board turned it down flatly. This was going to be a $1B+ company, and fast, they thought.

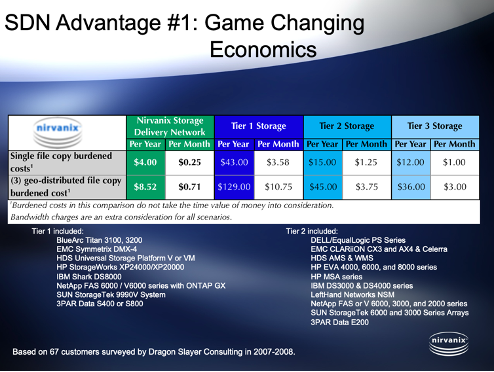

In the back of the minds of the senior team, however, was the looming threat of the ever-emerging Amazon Web Services. Amazon had the financial ability to drive the cost of storage toward zero with their economies of scale and we knew we were locked in a race against time. Onsite storage costs were also continuously falling so pricing pressure would be sure to emerge. The board didn’t care. It was full speed ahead. Our economics were compelling, but there was a ticking clock as to their competitiveness.

One day early into the next year, a database admin made a coding error. As a young company run by young executives, are processes and safety measures were lacking. 10s of thousands of the legacy consumer accounts from the former company, still very much alive, all got deleted. No restoral measures. This drove and absolute PR nightmare. Bloggers, press went wild claiming that this is why the cloud is unsafe. The company’s future was once again hanging in the balance.

The data loss story was hard to counter, but we all manned the message boards, the phone lines and the journalists. The data that was lost were isolated to the free legacy accounts and did not affect the enterprise side of the business thankfully. We recovered but it took time because the headlines weren’t great.

We employed scrappy, innovative techniques to get positive notoriety. One example is creating a campaign called “The Box is Dead” taking aim at onsite enterprise storage products. Before video was popular in social media, we created a scrappy video of our Facebook developer customer smashing a server in the desert with a sledgehammer. Our in-house Nirvanix band recorded a soundtrack for the piece. Once uploaded to YouTube, we emailed it to press and analysts industry wide to an amazing reception. We went viral before going viral was a thing. With just a very small PR budget we drove huge share of voice in the market up against $100B+ companies around the world. The link to a copy of the video is here.

Due to customer growth, new funding on the horizon, and the board’s feeling that the company needed to be matured in the wake of the data loss incident, Patrick hired a Dell heavyweight to come in as CFO. Major Horton was different. Up against the young, aggressive startup team, he was well, Dell. Big company guy. He brought structure to the company for sure but not always in productive ways. For instance, when I came on the company, I requested that I have a MacBook Pro. A Dell guy, Major insisted that, post-facto, I produce a cost-benefit analysis relative to Dell products.

We all got a corporate apartment just outside the Gaslamp District of San Diego in Little Italy. It was sparse with no furniture. Patrick’s EA was sent to buy us all mattresses at the Salvation Army store. We didn’t have frames to put them on so we laid them on the floor. It was designed to be as cheap as possible. This is where Major, Geoff, Edgard and Dan would hole up during work weeks in San Diego.

Major had a big company style and with that came politics. Soon came gaslighting and here say. The core startup team didn’t know how to handle this other than approach Patrick with the concerns. One thing we had as a team from the start was unity, trust and ambition. It seems some of this was starting to unravel and it all pointed back to one organizational manipulator. Major. Major held the cards, however. Patrick had to stand behind him with his board support. So, issues got suppressed but the tone of the organization turned.

The nightlife around the office was vibrant and this team worked hard and played hard, but the focus on the business did not wane.

Things were once again working. The company was maturing with additional senior talent coming on board, new nodes being built out and good deal flow. Here it was mid-2008 and we were on our way.

Funding from big partners like Intel started to close. Still the numbers weren’t big up against the huge players we were up against. Building out worldwide storage nodes for the SDN proved to be very expensive. We had awoken giants to enter the space thanks to our launch and industry press coverage. AWS was accelerating and taking steps to productize their S3 storage platform. We had to remain scrappy, lean and mean.

Then cracks in the seams started showing up in the economy. The stock market was becoming unsteady, the housing market looked to be crashing. A financial market meltdown was in the making. By the third quarter some enterprise deals started to fall, and Major started to panic, maybe rightly so in hindsight. He started to hit the brakes.

In accordance with my contract, I was to move to San Diego by Labor Day at the company’s limited expense and I executed on that plan. The company goal was to cut the travel expenses from the Bay Area and to eliminate the corporate apartment. I found an apartment, painted, bought furniture and everything to outfit my new home dedicated to the success of Nirvanix.

I took a week off of work to gather my things back home, get my affairs in order and to arrange the move to my new apartment. Over the week, Patrick stopped taking any calls, returning text or email. Completely. Major too. Something was up. But I continued and executed on the move.

I showed up to work on the Tuesday after Labor Day to my new office to find it wasn’t functional. Major stepped into my office and asked me to join him in the conference room. In there was the head of HR. Patrick walked in seconds later and shut the door. I was being fired -the day after I moved into my new corporate home. My first thought is that I just painted the apartment, I can’t get out of the lease and what am I going to do with all this new furniture? Patrick kept talking about something that just wasn’t true. There was no performance issue. We had hit the headwall in the economy fast. In hindsight I was the first of all of the original team to go, leaving only Major. The initial deal was that I was to get nothing – no move back money, no relief, nothing. Over the course of the week we settled but it still wasn’t particularly fair. I would stay on for six months with Nirvanix as a client to start my new marketing consulting firm and expenses were reimbursed. My journey with Nirvanix was over.

In starting my new firm shortly thereafter, I began working with Nirvanix’s VP of Business Development for the Entertainment industry, Ezra Davidson. He and I had grown close at Nirvanix before my departure in developing business together in LA. Ezra had brought to the company a young, female associate who turned out to be his mistress as time would reveal. With great irony, on our trips together in LA he would frequently give me marital advice. He was a very gentle soul and a pleasure to work with.

It was that 4th quarter of 2008 that Ezra and his assistant/companion were let go. He and I started developing business together. We had a deal in the pipeline with Quincy Jones, Jr. the son of the famous producer. We had other deals in the funnel too, but this was the most promising. The day after the New Year’s holiday was our next conference call with Quincy Jones, Jr.. I called in on time as did Quincy, but Ezra never showed. I couldn’t reach him on text or phone. We held on for almost 15 minutes but ended the call early.

It was only a week later that I learned of Ezra’s disappearance. My old PR agency had called me to say she read online that Ezra had been shot in the back of the head while sleeping by his wife on New Year’s Eve and she was in custody. Ezra, my Nirvanix friend was dead and his wife, Adriene had murdered him.

Apparently, ten days leading up to his death, Major Horton had sent company expense data to Ezra – but through his wife and not directly to him. It was clear in the documentation that Major was not going to reimburse some expenses that he felt were attributed to his mistress. This was not done without purpose. Ezra’s assistant weeks later told me that the email was no mistake.

This email was how his wife, Adriane, found out about the affair. Adriane, that day, went into a gun store near their home in Pomona, California and put herself on the 10-day waiting period list to buy a brand new Smith and Wesson 45 caliber pistol.

On New Year’s Eve, Adriane’s 10-day waiting period was up and she picked up the gun. After waiting for Ezra to slumber after they polished a champagne bottle together, she shot him in the back of the head, leaving their two children without a father.

The story of Ezra’s killing was widely covered in the press and led to a television episode on the matter. Oxygen Network’s True Crime series produced an episode on the dramatic events entitled, “Snapped – Adriene Davidson” Season 10, Episode 3. Adriene received 25 years to life in prison. The whole ordeal devastated me. Gone was my friend, Nirvanix colleague and now my partner in business. Major continued at Nirvanix for some time before the board let him go too, ending the tenure of any of the early Nivanix team. Major died on March 25, 2021

As the economy continued to falter into 2009, the board pulled in the purse strings further. The company started to layoff more of the team. By the close of the year all of the startup team, including the two founders were eliminated and with that went the passion, the drive and the ambition of the original culture. Left behind was Major Horton to run things with his spreadsheet and a carousel of new team members.

Nirvanix took in a series of CMOs and three more CEOs with new, notable investors between 2010 and 2013. The complete list of investors included now included:

- Mission Ventures: Early and continued investor. San Diego-based VC firm focused on early-stage tech

- Valhalla Partners: Participated in Series A and subsequent rounds. East Coast VC firm with focus on IT infrastructure

- Windward Ventures: Southern California VC firm that backed several early-stage tech startups

- Intel Capital: Joined in the December 2007 funding round. Strategic investor supporting cloud infrastructure innovation

- European Founders Fund (now Global Founders Capital): Participated in the 2007–2008 funding rounds. Backed several global tech ventures

- Khosla Ventures: Led the $25 million Series C round in 2012. Known for bold, high-risk tech bets in cloud and enterprise

Scott Genereux was appointed president and CEO of Nirvanix in November 2010, replacing Jim Zierick who had replace Patrick Harr earlier. Since then, the company overhauled its management team and signed a number of partners, including a 5-year OEM agreement with IBM. Nirvanix has also deployed petabyte-scale clouds at Cerner, USC, and others. In December 2012 Genereux left to join Oracle Corporation, and was replaced by Dru Borden, who was then replaced by Debra Chrapaty in March 2013.

Despite the earlier agreement, IBM acquired SoftLayer in June 2013 and started a competitor, IBM Cloud Services Division.

On September 16, 2013, Nirvanix notified customers that they had until September 30, 2013 to move their data off of the service at which point Nirvanix would shut down. By September 28, 2013, the company deactivated its website and replaced it with a statement that included customer support details. Nirvanix said an IBM team could assist customers with transferring their data from the Nirvanix infrastructure. The company filed for US Chapter 11 bankruptcy on October 1, 2013, which was approved on October 8. Oracle Corporations the proceed to buy the Intellectual Property, assets and engineering resources.

This very high-profile industry shutdown left many asking if the dream of cloud storage as dead. Clearly it was not.

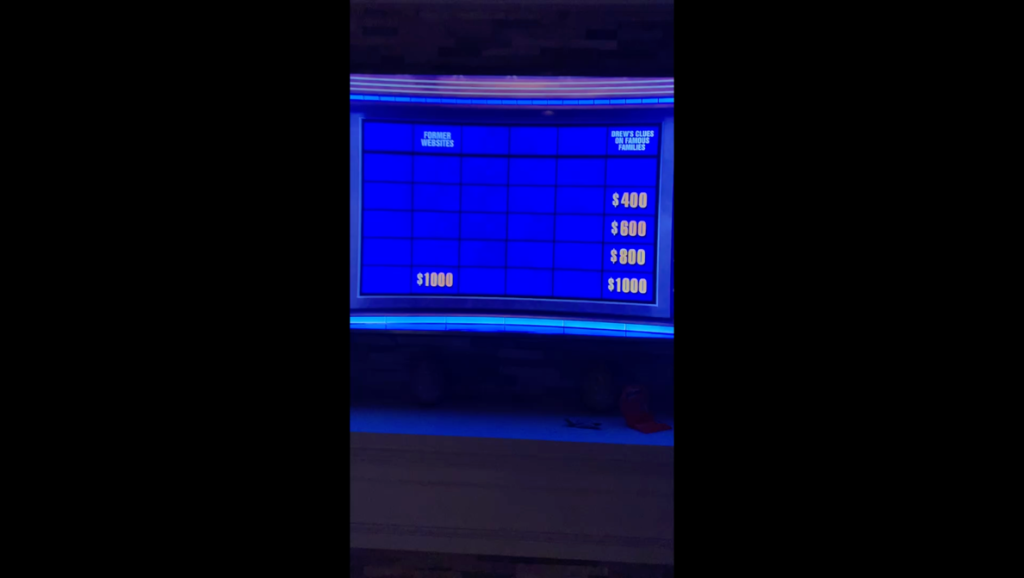

It was April of 2021 when I was watching Jeopardy!, the television game show, when the $1,000 tech Jeopardy! Question came on the screen.

“Customers of Nirvanix, one of these atmospheric storage services, had to scramble when the company closed up shop.” Answer: The Cloud.

Yes, in all of this, with a modest budget and a focused team, at least help give birth to a whole new category of computing.

#StartupLife #TechHistory #CloudComputing #EnterpriseTech #SaaS #FoundersStory #TrueTechStory #StartupMemoir #WhatReallyHappened #StartupDrama #BoldMoves #LessonsLearned #DisruptiveTech #ViralMarketing #AWSvsTheWorld